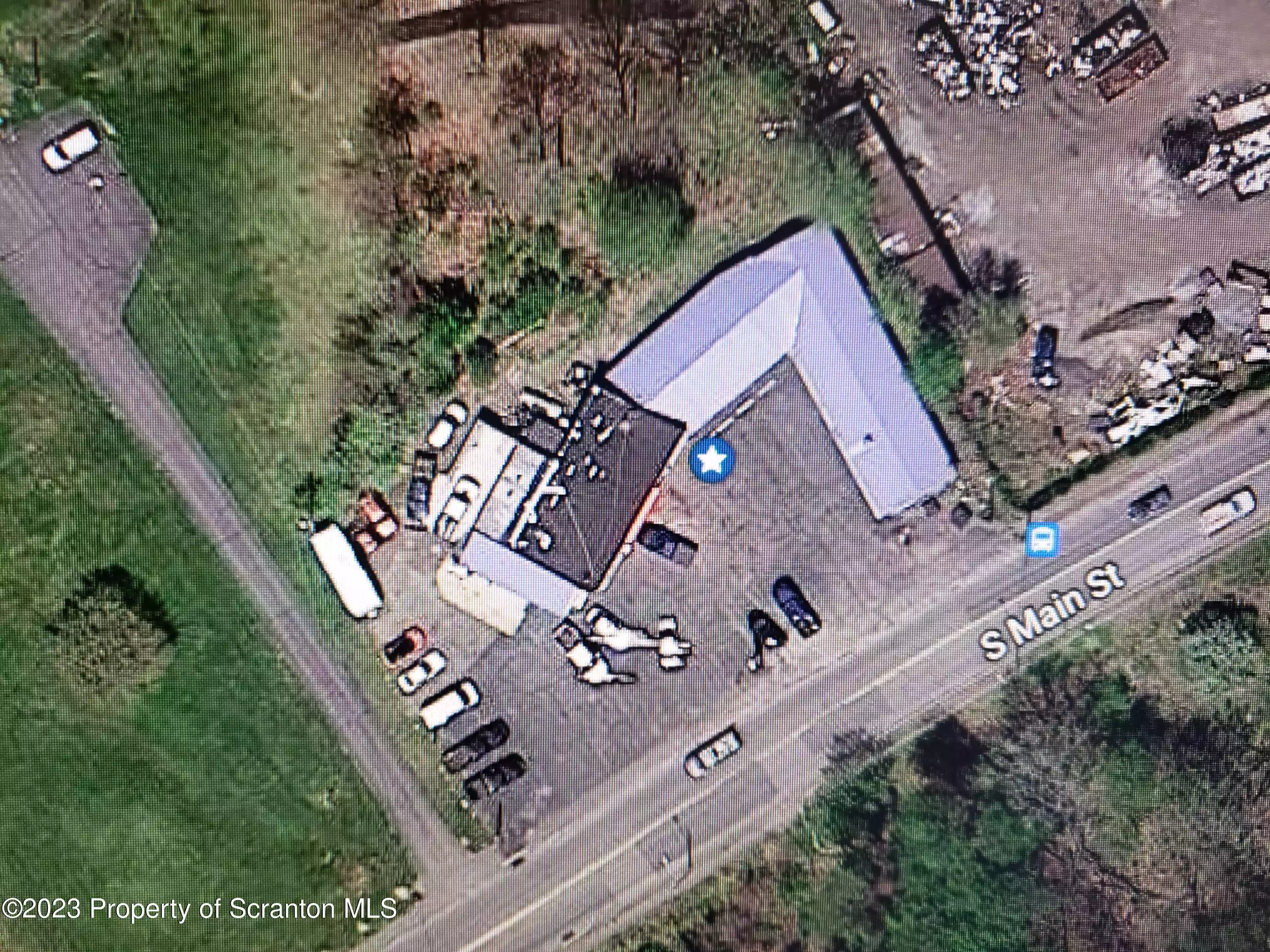

Commercial Property for Sale in Archbald, PA

Find an Agent in Archbald, PA

Speak To An Agent Now Find An Agent

Let’s talk! Call us @ 570-585-6880

Commercial Real Estate for Sale in Archbald, PA

There are several good reasons to explore commercial property for sale in Archbald PA. The town has a rapidly growing economy, thanks to the presence of large businesses such as Lockheed Martin. The city also has a thriving small business sector and a stable and growing population, which translates to a steady customer base for any commercial venture. Archbald’s commercial real estate market has remained relatively stable, with selling prices similar to the rest of our region. Furthermore, the town’s location makes it an attractive investment option as it is within a commutable distance to bigger cities like Scranton and Wilkes-Barre. Thus, a potential investment in commercial real estate in Archbald, PA, is a wise decision as the town’s economy and population continue to grow.

About Archbald, PA

Archbald, Pennsylvania is a small yet vibrant town located in Lackawanna County. The commercial real estate market in Archbald is currently offering a range of properties for sale, including retail spaces, office buildings, and warehouses. The town’s strategic location, with easy access to major highways and proximity to larger cities such as Scranton and Wilkes-Barre, makes it an attractive destination for businesses looking to establish a presence in Northeastern Pennsylvania. With its growing economy, friendly community, and diverse business opportunities, Archbald continues to be a sought-after location for commercial real estate investments.

More Commercial Real Estate Search Options

Commercial Property Carbondale, PA

Commercial Property Clarks Summit, PA

Commercial Property Dickson City, PA

Commercial Property Dunmore, PA

Commercial Property Factoryville, PA

Commercial Property Jessup, PA

Commercial Property Moscow, PA

Commercial Property Old Forge, PA

Commercial Property Pittston, PA

Commercial Property Scranton, PA

Commercial Property Tunkhannock, PA

FAQs

How long does it take to close on a commercial property?

With the complexity involved in commercial real estate loans, it usually takes about three or four months to close on a typical commercial loan. Quicker deals can come together between seventy-five and ninety days to close on a commercial property, though there are exceptions.

As an investor, make sure you have sufficient time for due diligence – a period of time for completing inspections and investigating intended use, among other things. Before setting a closing date, the purchaser and their agent should consult (real estate/title) attorneys, engineers, inspectors and any other professionals needed to make sure they’re ready to close the deal. All parties will need to be mindful of their availability as well.

What is the process to buy a commercial property?

Purchasing a commercial property can be a complex matter, especially as it pertains to the buyer’s analysis. That’s why it’s imperative that you have enough time to investigate. Here are the major points when buying a commercial property:

- Hire an experienced commercial real estate agent

- Determine the type of commercial property you need

- Identify potential properties to buy

- Set up a showing

- Decide upon which listing meets your needs

- Make an offer

- Sign a sales agreement

- Perform due diligence

- Complete a final walkthrough of the property

- Close on the property

Remember, we’re here to help you navigate through these steps.

How long are commercial real estate loans?

Commercial real estate loans range from five to ten year terms, but are amortized up to a 25-year term. The longer the loan term, the less the monthly payment. However, a longer loan term means greater interest costs associated with the loan.

In a situation where a 5-year term was taken for a commercial loan (amortization period of twenty-five years), the investor would make monthly payments over the course of five years based upon the loan being paid off over twenty-five years. At the end of the five years, one balloon payment would need to be made in order to pay off the remaining balance of the loan in full.